Negative Gearing

What is Negative Gearing?

Negative Gearing by definition is where you borrow to acquire an investment and the interest and other tax deductible costs you incur exceed the income you receive from the investment.

While Negative Gearing is commonly associated with rental properties, it can also be applied to other types of income-producing investments such as shares and managed funds using what is often called ‘margin loans’. In terms of property investment, negative gearing refers to a situation where your expenses to maintain the property (including mortgage interest) exceed the rental income.

Creating wealth through purchasing an investment property is a well established practice in this country. The attraction of borrowing or gearing to invest is that it enables you to invest in shares or property that might otherwise have been unaffordable. For individuals, the loss can also be offset against other assessable income and the tax benefit will depend on your marginal tax rate.

The Risks

Make no mistake, it can be a risky business because while gearing can amplify your gains, it can also magnify your losses. There is no better example than the 2008 US sub-prime lending crisis where the collapse of the US Property Market left some 30% of mortgagees with a loan balance higher than the value of their property.

If you negatively gear property, you need to understand some important points:

- Properties are expected to generate profits only through capital gains and the gains need to be greater than the total losses incurred over the course of the holding period. Of course, there is no guarantee that the value of the property will appreciate, or at least appreciate enough to cover your losses.

- Investing in property requires planning and extra caution must be exercised when a property is projected to generate a negative cash flow. Tax benefits should not be the only reason for the property purchase.

- For taxation purposes, depreciation on the building could be tax deductible, however, the depreciation also reduces the ‘cost base’ of the property. The greater the depreciation you apply on your property, the lower the cost base value which may result in a larger taxable capital gain on sale.

- Negative Gearing isn’t suitable for all investors. Although it can lower your tax liability, the tax implications will depend on your personal situation and the type of investment you choose. Negative Gearing implies a negative cashflow that you need to fund from other sources.

- You have to remember that the family home is a purchase from the heart while an investment property needs to be a purchase from the head. You’ve heard the old saying that the three most important things when buying a property are: ‘location, location, location’ and this is even more important when buying an investment property.

Case Study

Let’s assume you buy a unit for $400,000 in your personal name and borrow $350,000 to fund the purchase. The funds are borrowed at an interest rate of 8% and the weekly rent is $450 or $23,400 a year. Ongoing costs including agent’s fees at 7% of the rent, rates, insurance, repairs and maintenance and other expenses are summarised below:

Profit & Loss Statement

Rental Income – 52 Weeks @ $450 |

| $23,400 |

|

|

|

Interest – $350,000 @ 8% | $28,000 |

|

Water Rates | 968 |

|

Council Rates | 1,282 |

|

Insurance | 900 |

|

Repairs & Maintenance | 600 |

|

Agents Commission – 7% of $23,400 | 1,638 |

|

Bank Charges | 12 |

|

Body Corporate Fees | 1,000 | $34,400 |

|

|

|

Net Profit (Loss) |

| (11,000) |

After expenses, net income for the year will be $17,000 ($23,400 minus $6,400), equivalent to a net rental yield of 4.25%. However, annual interest repayments are $28,000, so you have actually ‘lost’ $11,000 during the year ($23,400 minus $34,400 = -$11,000).

In this example, you will reduce your taxable income by $11,000 being a loss on the investment property. If you had a taxable income greater than $150,000 in the 2008 financial year you would be on the highest marginal tax rate of 46.5% (including the Medicare levy) and this tax deduction would have the ultimate effect of reducing the after tax loss on the property from $11,000 to $5,885 or $113.17 per week.

If you are on a lower rate of tax of 31.5% (including Medicare levy) the after tax loss on the investment would be reduced from $11,000 to $7,535 (or $144.90 per week).

How We Can Help

The real benefits of negative gearing are only realized when you combine the correct tax and financial advice with the right property and loan product. You should always seek expert advice to make sure the purchase is within your budget and will provide taxation and financial benefits in the long run.

When buying an investment property we can assist you in several areas:

- We have written a comprehensive booklet on Negative Gearing that explores what you can claim, what costs form part of the cost base for capital gains tax purposes and how negative gearing works for tax purposes. It is available to our clients in conjunction with a negative gearing consultation.

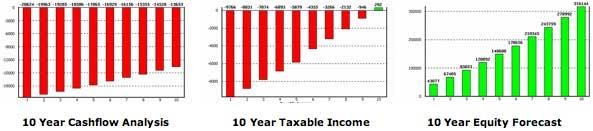

- Evaluate the tax consequences – Using an intelligent software tool we can prepare a 10 year cash flow analysis of the proposed property, taxable income forecasts and equity projections.

- Where to buy – through the services of a buyer’s advocate we are able to help you locate the right property in the right location.

- Finance – through our affiliation with a mortgage broking group we can help you find the right loan that is correctly structured for taxation effect.

- The tax loss on the property can pose a major cashflow issue, however, we can prepare a PAYG variation application so that your regular paypacket reflects the annual tax saving.

If you are interested in finding out more about negative gearing call our office today.

Keep Excellent Records for Your Investment Property.

As your accountants we are committed to helping you simplify your record keeping and aim to minimize your tax return preparation costs.

Rent Manager

If you own an investment property Rent Manager will keep all your rental property tax records in one place.

Historically we have found the calculation of capital gains on the sale of property to be a source of major headaches and frustration due to the loss of source documents. Rent Manager keeps your purchase and sale records for capital gains tax purposes plus all the information you need to prepare your annual tax returns. It also allows you to analyse potential investment property purchases through the ‘property analysis’ module.

Rent Manager includes the following features:

- Record the rental income and expenditure for your investment property

- Record information from the real estate agent monthly rental summaries

- Keep track of any mortgages including interest and bank charges

- Keep a log of your car travel for collecting rent and conducting property inspections

- The Annual Summary provides all the information for completing your annual tax return

- Keep records for multiple properties

- Calculate Depreciation of furniture & fittings

- Calculate Tax Deductible Building Allowances

- Record ‘cost base’ details and any loans to finance the property.

- Record property purchase, sale and improvement details so you don’t get caught when you need this information for Capital Gains calculations

- Easy to follow manual and online help

- Print all the key reports that your accountant needs to complete your tax returns

- Full 90 day money back guarantee

Rent Manager is the perfect tool to manage your property, makes completing your tax returns easy and gives you peace of mind that you have the capital gains tax information you need when you finally come to sell the property. Copies are available from our office.